URI economics professors ease concerns of influence on community

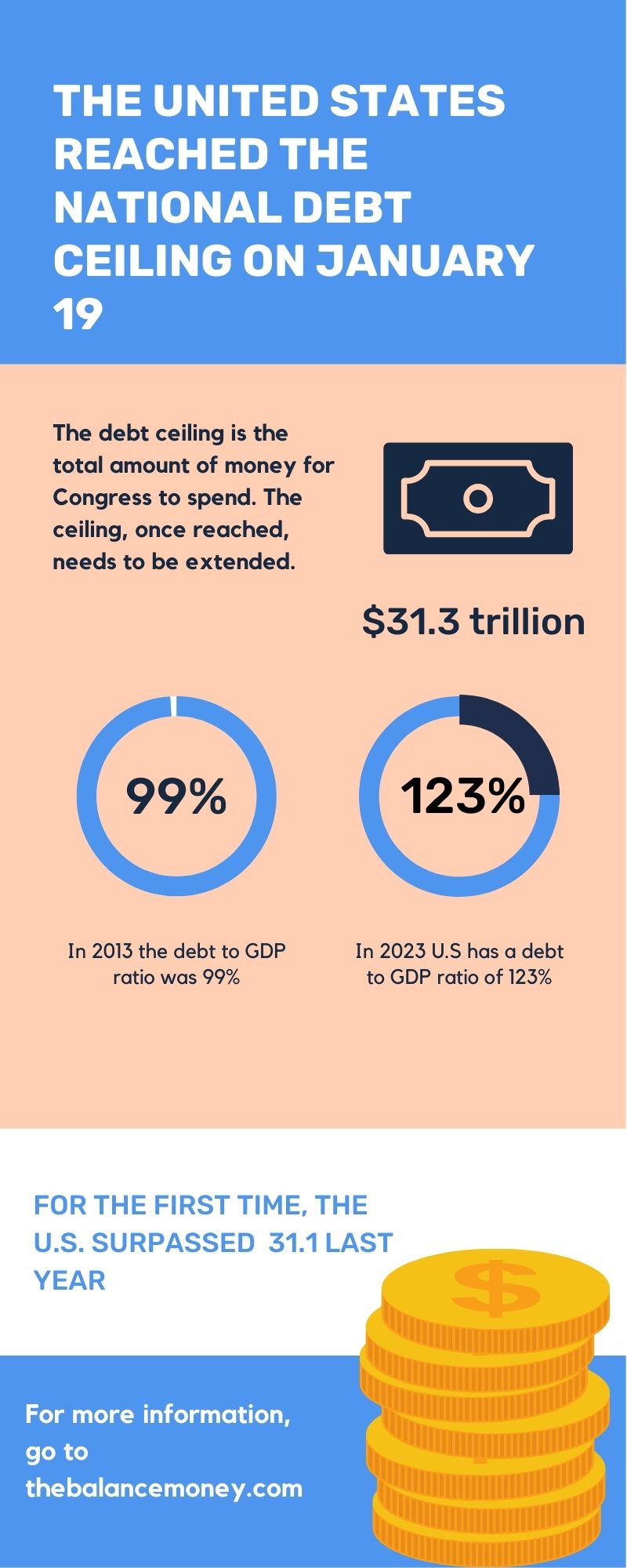

The U.S. and the national debt ceiling over the years. Graphic by: Maddie Bataille | Photo Editor

As of Jan. 19, the United States reached the debt ceiling, but we don’t need to worry about it yet, according to Liam Malloy, an associate professor and chair of the department of economics.

Malloy said the debt ceiling is the total amount of money Congress uses for spending. It decides what the monetary amount of taxes are going to be and how much it’s going to cost. If the tax revenue is less than what they want to spend, they have to borrow money from government bonds.

“So now, Congress not only passes the spending and taxing laws, but they also have to extend that debt ceiling once we get a certain amount,” Malloy said. “At this point, it’s around $31 trillion.”

Malloy added that this issue doesn’t affect the average American because the debt ceiling hasn’t been a big issue due to controlled government spending. Instead, the economy is more affected. The real problem is the possibility that the government will borrow too much money. If borrowing gets out of control, interest rates are higher and tax revenue decreases.

“However, we shouldn’t worry about this too much because we’ve had low interest rates,” Malloy said. “So, even though the debt has gotten higher, we aren’t spending any more as a percentage of the budget.”

On the other hand, the government may not always pay back their debt. Sometimes, they might pay half of it or none at all for any reason. The most likely reason is that the U.S stops making payments because one party might not want to increase the debt ceiling, Malloy states.

Economics assistant professor Nina Eichacker said the only way U.S citizens may not get paid back their debt is due to suspended payment into certain accounts, particularly retirement accounts for federal employees. Secretary of Treasury Janet Yellen has been moving funds around and this has negative implications for them because it means they are earning less potential revenue on savings plans they’ve been contributing to.

“U.S. employees may not see the results of that until they eventually retire,” Eichacker said. “People in the U.S. don’t necessarily see the consequences of this until either the government runs out of extraordinary measures.”

Eichacker also said in order to prevent these issues from happening, you have to raise the debt limit so the U.S. can continue to issue debt to meet its current obligations.

“This includes paying interest on the debt that it has outstanding, but also has to pay out the programs it has promised to spend on,” Eichacker said.

She also stated that in the short run these issues probably won’t occur. Eichacker stated Congress is pretty sure if they come up, it will be resolved because they know it’s their obligation to fix them and will do so if needed.No spending has had to be cut and there is no rush for borrowing more money from the government.

“I think if people in the business community believed that the government were in fact going to default on its obligations, they would be caving right now,” Eichacker said. “We haven’t seen global investors start to sell off bonds, so if issues come up, they’re confident that they can fix them.”

Furthermore, Eichacker said that while the average American doesn’t seem to be affected by this, the implications are different for underrepresented groups. These groups include poor white Americans and people of color. If the government cuts spending, these groups will feel more under pressure because they receive less government benefits than large populations of wealthy, white Americans.

“When it comes to the effects of a default on portfolios, underrepresented groups tend to have smaller wealth holdings,” Eichacker said. “If the government starts to cut spending, these groups are forced to sell off bonds and so on, which could compound in ways that affect all sorts of people. My guess is that if economic conditions start to get worse, people in the business community are going to start lobbying for another raise in the debt ceiling.”