Most young adults in their 20s are thinking about buying the newest video game, parts for their car, doing well in college, or the newest smartphone. None take the time to contemplate large scale investments like buying a home. But little do they know, if they are attending college they are most likely making a similar size investment.

Attending college can now cost just as much, if not more, than owning a home. There are, however, a few major differences between investing in a home and investing in your education. A home comes with guaranteed equity, promise of a roof, a warm place to stay, and countless other amenities.

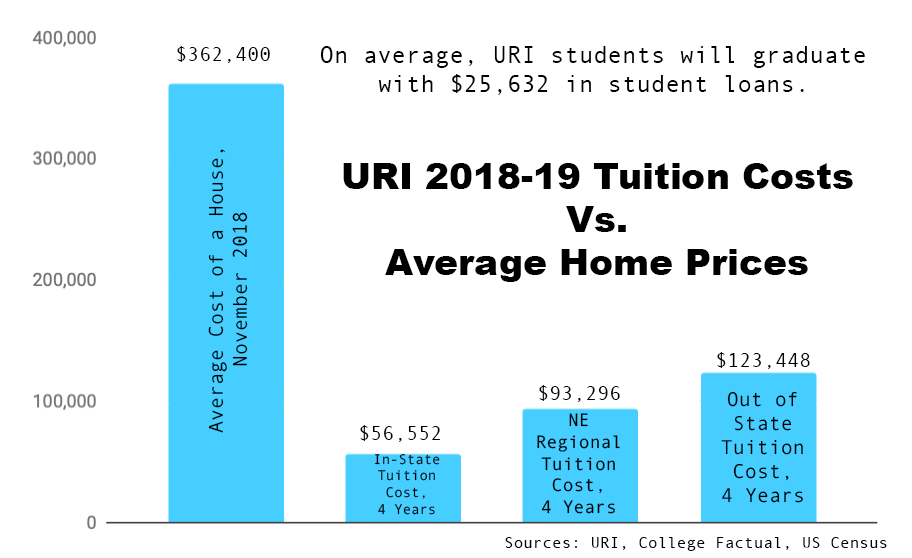

Paying for a college education guarantees you overpriced textbooks, countless hours in the library and a lousy piece of paper that tells you what you’re worth. That paper does not, however, guarantee a salary, a roof over your head, food in your belly, or a life after school. For example, to attend the University of Rhode Island, tuition alone costs anywhere from $26,666 to $43,390 per year for four years depending on where you are from. All this provides is a house worth of debt. What has the world come to where someone in their 20s who should be focused on learning and bettering themselves has to worry about their entire financial future?

As a 21 year old myself I see student loans as nothing but a burden. Not only am I stressed about my education, but I’m also worried about how I’m going to pay back these home sized loans. According to Forbes Magazine, there is an estimated $1.5 trillion in student debt spread over more than 44 million people across the United States. How does the U.S. plan to develop and grow in the future if a large percentage of its population is drowning in student loan debt?

In order to fix this the government needs to take action. Students like myself are starting to feel the financial burden as early as freshman year of college. Now in my junior year, my monthly loan payments are hard to keep up with and hinder my ability to go out and be an active young adult.

What needs to be done? The answer could be increased federal funding or more opportunities for students to work while attending school or countless other things. Either way, there needs to be a change for the students of today, and more importantly, the students of tomorrow. The government needs to stop having a conversation about the loan epidemic and start taking action.

Alexander L. Allard